2024 Roth Ira Agi Limits

2024 Roth Ira Agi Limits. Roth ira agi limits 2024. People age 50 or older can contribute up to $7,500 for tax year.

» understand how the roth ira contribution limit works. For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who.

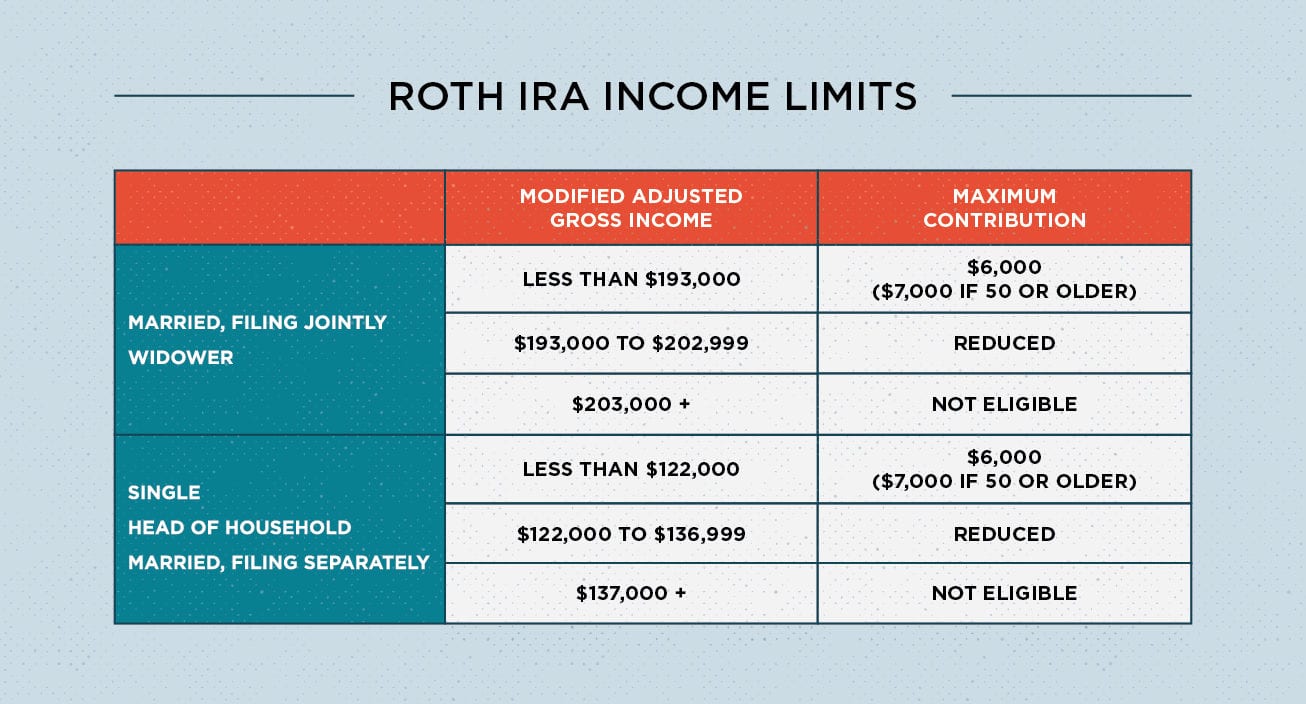

Learn The Roth Ira Contribution Limits For 2023 And 2024, And Roth Ira Income Limits Here.

You’re married filing jointly or a qualifying widow(er) with an agi of $240,000 or more.

Amount Of Roth Ira Contributions That You Can Make For 2023 | Internal Revenue Service.

For taxpayers 50 and older, this limit increases to $8,000.

If You Are 50 Or.

Images References :

Source: ardythqhermione.pages.dev

Source: ardythqhermione.pages.dev

Roth Contribution Limits 2024 Minda Lianna, This is up from the ira. You file single or head of.

Source: www.savingtoinvest.com

Source: www.savingtoinvest.com

Roth IRA contribution limits — Saving to Invest, This is up from the ira. But the countdown begins on jan.

Source: time.com

Source: time.com

Roth IRA Contribution and Limits 2023/2024 TIME Stamped, This table shows whether your contribution to a roth ira is affected. To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

Source: ladonnawsonya.pages.dev

Source: ladonnawsonya.pages.dev

Limit Roth Ira 2024 Sadye Conchita, Roth ira contribution limits in 2024. In 2024 you can contribute up to $7,000 or.

Source: jordainwilysa.pages.dev

Source: jordainwilysa.pages.dev

Roth Limits For 2024 Jayme Iolande, A roth ira conversion is the process of rolling funds from a pretax retirement account into a roth ira. Because traditional iras and 401 (k)s have different tax.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, What are the roth ira income limits for 2024? 2024 roth ira contribution limits.

Source: annadianewminne.pages.dev

Source: annadianewminne.pages.dev

Roth Ira Contribution Limits 2024 Deadline Joete Lynsey, Amount of roth ira contributions that you can make for 2023 | internal revenue service. Fact checked by kirsten rohrs.

Source: www.carboncollective.co

Source: www.carboncollective.co

Roth IRA vs 401(k) A Side by Side Comparison, A roth ira conversion is the process of rolling funds from a pretax retirement account into a roth ira. Roth ira agi limits 2024.

Source: www.bestpracticeinhr.com

Source: www.bestpracticeinhr.com

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, What are the roth ira income limits for 2024? This figure is up from the 2023 limit of $6,500.

Source: db-excel.com

Source: db-excel.com

Roth Ira Rules What You Need To Know In 2019 Intuit Turbo —, Roth ira contribution limits for 2023 and 2024. Eligible participants under the age of 50 can contribute up to $6,500 for tax year 2023 and $7,000 for tax year 2024.

What Are The 2024 Roth Ira Income Limits?

For 2024, the irs only allows you to save a total of $7,000 across all.

Because Traditional Iras And 401 (K)S Have Different Tax.

For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.