Gift Tax Exemption 2024 India

Gift Tax Exemption 2024 India. Confused about the gift tax in india? Gifts as per the income tax act can be classified as follows:.

Know about gift tax, how are gifts taxed & when are gifts exempted from income tax in india How to get help from eztax.in.

Gift Tax Exemption 2024 India Images References :

Source: www.youtube.com

Source: www.youtube.com

Gift Tax in India, Tax On Gift, Exemption from Gift Tax YouTube, As per the provisions of section 56 (2) of the income tax act, 1961, any gifts (in cash or kind) received by an individual or huf (hindu undivided family) over rs.

Source: caryqemelina.pages.dev

Source: caryqemelina.pages.dev

Annual Gift Tax Limit 2024 Aleda Aundrea, This article provides list of relatives covered section 56 (2) (vii) of the income tax act,1961.

Source: gaylaqchristi.pages.dev

Source: gaylaqchristi.pages.dev

Gst Exemption 2024 Wilie Julianna, Gifts by resident indian relatives to nri are exempt, as are gifts up to a value of rs 50,000 given by resident indian friends and acquaintances.

Source: www.edules.com

Source: www.edules.com

Budget 2024 People want these 4 tax exemptions in the budget, As per the provisions of section 56 (2) of the income tax act, 1961, any gifts (in cash or kind) received by an individual or huf (hindu undivided family) over rs.

Source: www.youtube.com

Source: www.youtube.com

Gift by NRI to Resident Indian or ViceVersa Tax Exemptions YouTube, The indian government introduced the tax on gifts in april 1958, and the gift tax act regulates it.

Source: jehannawrosy.pages.dev

Source: jehannawrosy.pages.dev

2024 New Tax Deductions Jody Rosina, Complete insights into the rules, exemptions, and strategic considerations for managing nri gift tax in india effectively.

Source: babatax.com

Source: babatax.com

Tax on Gift in India Tax on Gift of money, property Exemptions, The said act was introduced to impose taxation on the.

Source: www.youtube.com

Source: www.youtube.com

New vs. Old Tax Regime in India Exemptions Explained (Save BIG on, For example, if your parents send rs.10 lakh to your bank account as a wedding gift, it will not be taxable.

Source: www.carboncollective.co

Source: www.carboncollective.co

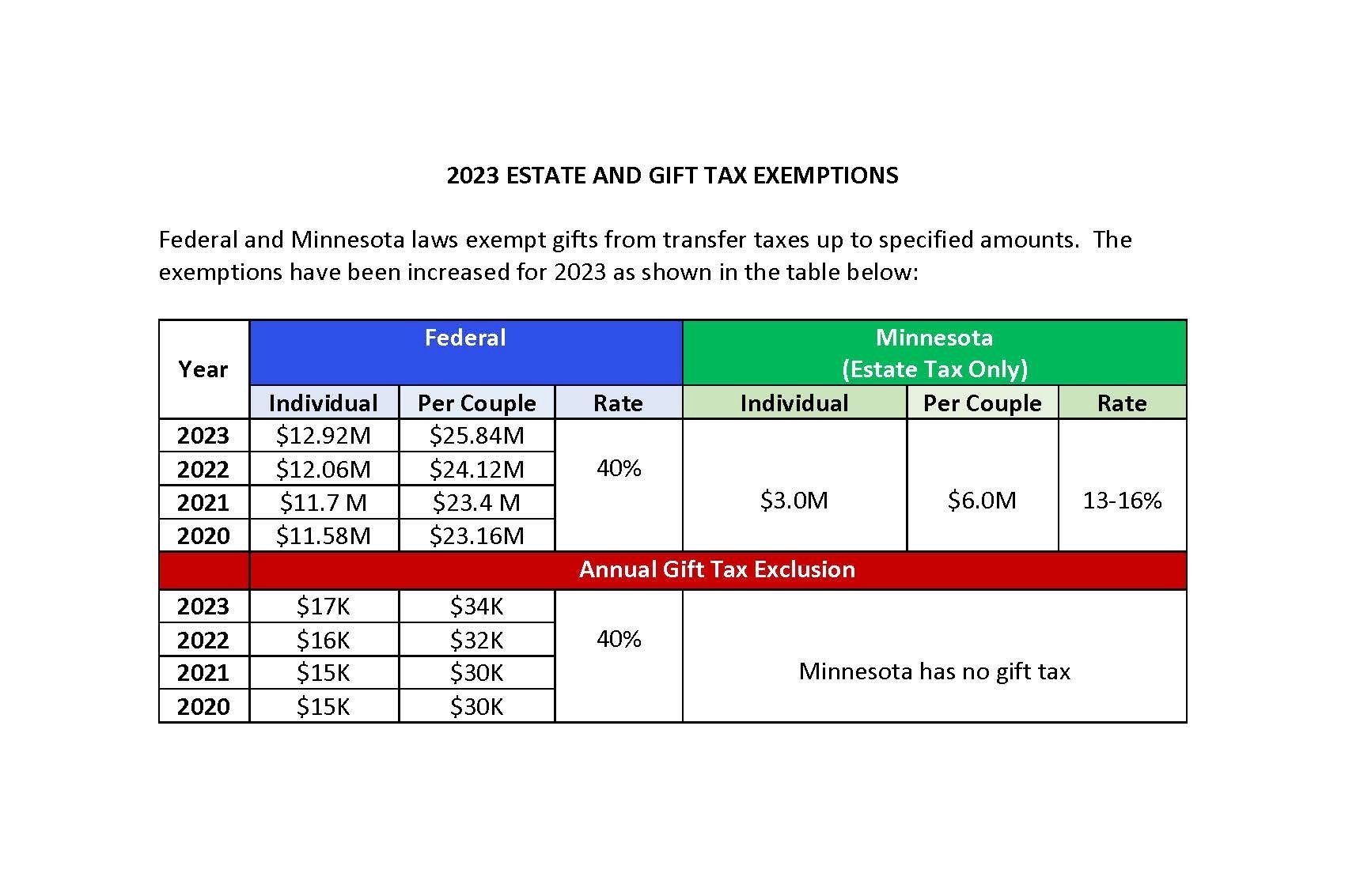

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, Gifts as per the income tax act can be classified as follows:.

.jpg) Source: marloqleticia.pages.dev

Source: marloqleticia.pages.dev

Gift Lifetime Exemption 2024 Ertha Jacquie, The exemption includes movable and immovable.

Category: 2024